- Stopped out on my position on FTV.

- OI also didn't do quite well, my order hit but the stock weakened subsequently and is now trading near my stop.

- IIIV has some potential so I'm holding

- No new positions/orders today.

Thursday, February 20, 2020

Stop outs left and right

Thursday, February 13, 2020

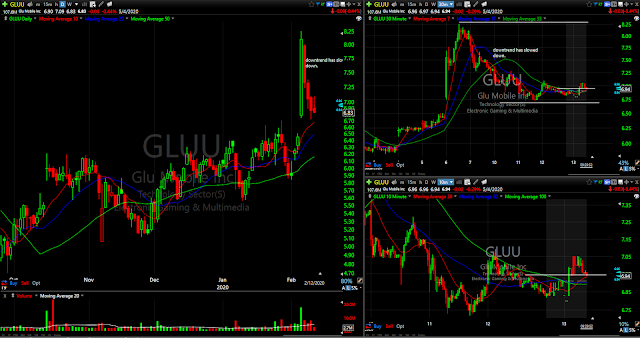

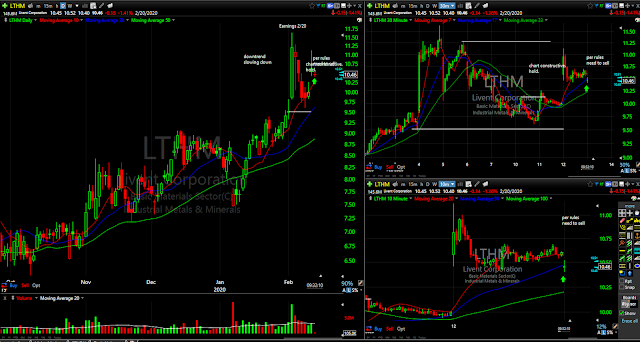

Selling LTHM, Long on GLUU

I really like this setup here. Slowing down momentum on the pullback and a nice setup on the intraday candles. I'm long on 6.95. It went past my stop limit so I'm not sure if I'm going to get hit or this is just going to go up without me. We'll see. Edit: canceled order on this one. It went strong at the open and didn't hit my order. If it went back to my stop limit price it would have done so with some form of selling pressure which I don't want (might get caught on the way down). Oh well missed opportunity. there will be more.

I planned to sell LTHM which I already did because it doesn't seem like it is going to trend on the 10 minute charts. It consolidated throughout the day yesterday per my rules I need to sell it when it stops trending on the intraday charts. At least I got out with a profit of $26. LOL.

Wednesday, February 12, 2020

Some Lessons

Yesterday’s stop out session was a lesson learned. I know i used to put in orders only after the 15 minute mark after the open and I didn’t do that for some of my trades. Although the flipside of it is that i wouldn’t have caught the massive move in my LJPC (was it this stock). I guess this is the trade off. So am I supposed to put in orders or just allow myself to stop out?

Now that I’ve been thinking about it. I think I should not put a timer on. Because the upside could be multiples to the downside if the price action was strong.

I still have an open position in one stock and I am holding it since the chart seems quite strong.

I don’t have any new setups that I like. This makes me feel that I’m unproductive. I know I shouldn’t be feeling that way.

Tuesday, February 11, 2020

FRTA and LTHM

Like this setup. It's pulling back from a nice burst of momentum and i'm betting on a bounce at this point. The 30 minute chart seems to show slowing downward momentum and there seems to be a nice risk/reward opportunity in the 30 minute time frame. On the 10 minute time frame I am long when it trades above the horizontal line, which could get the stock trending again even if for a while.

FRTA has the same setup with the added bonus of a "double bottom" both on the 30 minute timeframe and the 10 minute time frame. Half-expecting this to trade upwards to the last major swing high. I feel though that my stop is a little too tight, but I'm going for it and reduced a bit of size. Let's see.

Thursday, February 6, 2020

Some good trades LJPC and ENDP

ENDP was a nice trade as well, although I left some money on the table. I went long on the break of that range (rectangle). I decided that I wanted to sell the stock a day later when it looked like it was starting to lose momentum. The next day the stock went up by a lot and I saw my chance to sell into strength at around $6.04. The stock went as high as $6.35 on the intraday. Nevertheless I was happy with what I got.

LJPC is my biggest single win so far this year, profiting over 4x my intended risk. I think I closed out on it with a nice $300 profit or so. The stock just proceeded to gap up and just reach higher for whatever reason. I really don't know. All I know is that I was able to advantage of a pullback setup.

I'm starting to like this style of entering on the 10 minute chart. What I look for is a breakout from a consolidation in this time frame or a sign thatte stock will be trending once again. The LJPC trade initially looked like it wouldn't work. so I took advantage of the strong day on the 5th to sell. Have to look for more of these things.

Have a buy order on HZO which I believe looks similar to LJPC and ENDP. Hope this setup works out. 10 minute chart on the lower right...prepared to go long once it goes past that range (around $20.50 is my stop order).

Wednesday, February 5, 2020

Sold: ENDP EHTH and LJPC

Finally got my piece of profits :) Trade Review soon :) Sold everything at the green.

Have a standing order on CTXS long. Not yet hit so we'll see.

Have a standing order on CTXS long. Not yet hit so we'll see.

Monday, February 3, 2020

Long: ENDP SAVA

Buy stops and sell stops look very tight on both of these things. But it's because I'm really trading the intraday 5 minute charts. Trying these out for now.

Both stocks have shown quite a bit of momentum, so I am still basing my trades on that one and riding them out.

These are the charts in multiple timeframes with some annotations on where I want them to go. Again this is based on Brian Shannon's work that I'm trying to apply to my own trading.

Subscribe to:

Posts (Atom)